What Is a VC Platform? Why Emerging Funds Are Building One Now

If you're part of an emerging venture fund, you’ve likely heard the term “VC platform” come up more and more, especially in conversations about founder support, LP expectations, and standing out in a crowded market.

But what does “platform” actually mean in the context of venture capital, and more importantly, does your fund need one?

While the concept can feel abstract or reserved for larger firms, platform has become a powerful (and increasingly expected) way for growing VC funds to add post-investment value without dramatically expanding headcount. From helping founders hire and scale faster to streamlining vendor relationships, platform strategy is quickly becoming a must-have, not a nice-to-have.

In this guide, we’ll break down exactly what a VC platform is, how it works, and why more small-to-mid-sized funds are choosing to build one now. Whether you’re still exploring the concept or thinking about your first hire, this is your starting point.

What Exactly Is a VC Platform?

At its core, a VC platform is the set of resources, services, and systems a venture firm offers its portfolio founders beyond capital. It’s how firms help startups grow faster, avoid common pitfalls, and feel supported, without relying solely on investors for day-to-day help.

In simple terms, platform is about delivering post-investment value in ways that are structured, repeatable, and scalable.

These services can include everything from talent introductions and vendor discounts to community events, content, marketing support, operational tools, and strategic guidance. While the terminology varies, some firms refer to it as “portfolio success,” “community,” or “value creation,” the goal remains the same: to help founders succeed and create leverage for the fund.

As Belle Raab, Director of Growth at Visible.vc puts it:

“Platform is formalized post-investment support and services that VCs provide to their portfolio companies to help increase their chances of success and differentiate the VC firm.”

And she’s right.

So, to sum it up, what is a VC platform? For emerging firms, it's a marketplace differentiator.

Why Founders Expect More Than Just Capital

Today’s best founders have options, and they’re increasingly drawn to firms that offer real, tangible help after the check clears. They want:

- Hiring support and talent pipelines

- Strategic vendor introductions

- Tactical help with go-to-market, fundraising, or finance

- A peer community of fellow operators and founders

- Mentorship, templates, or warm intros from experienced advisors

This shift in founder expectations is one of the main reasons emerging VC funds are investing in platform development early, even if they don’t yet have a formal team.

Why VCs Are Building Platforms Sooner Rather Than Later

For fund managers, there are three big reasons to build platform capability even in lean form:

1. Attract Better Deals

Founders talk. Firms that add real value tend to earn more warm referrals and attract top-tier talent. A thoughtful platform offering makes your firm stand out in a competitive market.

2. Improve Portfolio Outcomes

Platform support helps companies navigate challenges faster, connect to the right resources, and avoid costly mistakes, thereby increasing the likelihood of follow-on success.

3. Free Up Partners’ Time

Centralizing key resources like tools, vendor contacts, and introduction platforms helps streamline operations, minimizes bottlenecks, and allows deal teams to focus on sourcing, due diligence, and strategic funding decisions.

What does platform look like for VC firms?

Platform can look very different depending the fund. The shape of a platform depends entirely on a fund’s size, goals, and portfolio needs:

- Some funds build a full platform team: Ops leads, marketers, talent specialists, and event managers working together to support founders across multiple functions.

- Others start with a single person or even a fractional hire who wears multiple hats, running point on talent, events, and community building as the first platform lead.

- And many start lean, using tools, tech stacks, curated resources, and external partners to deliver support without building out a full team.

What matters isn’t how big your platform is, it’s whether it’s intentional, relevant to your portfolio, and designed to scale with your fund.

Designing a Platform Strategy That Fits Your Fund

Once you understand what a VC platform is, the next question is: what should your version of it look like?

Not every venture capital fund needs a significant platform team from day one. But most VC firms can benefit from defining a platform function that aligns with their investment strategy, startup support philosophy, and internal bandwidth.

A thoughtful platform strategy helps venture capital firms deliver consistent, post-investment support that’s scalable, cost-effective, and relevant to their portfolio companies.

The best strategies start with clarity around which problems you want to solve for your founders, and which functions you’re positioned to execute well.

Here are a few practical models we've seen work across emerging venture firms:

1. The One-Person Platform

Often filled by a head of platform, platform manager, or platform specialist, this model focuses on high-impact support across key non-investment functions like:

- Talent acquisition & recruiting referrals

- Business development and customer introductions

- Community building via events and online forums

- Curated vendor access and right service providers

- Content or marketing to boost firm's visibility and investor relations

Many platform professionals in these roles operate as the connective tissue between core team members, portfolio founders, and external partners, supporting the firm’s portfolio companies while staying lean.

2. The Tool-Stack Approach

Rather than hiring immediately, some early-stage funds focus on systems and scalable assets. In other words, a tech-enabled way to provide value without growing headcount.

For example:

- A pre-built marketplace of pre-approved vendors

- Airtable-based deal flow or investment operations trackers

- Community platforms for peer support among portfolio CEOs

- Shared templates for risk management, GTM, and data analytics

- Integration with platforms like Carta, Proven, or Backstop to enhance investment decisions and founder ops

This approach works well for VC firms with eight core employees or fewer, especially those testing platform ROI before deeper investment.

Bonus: Want to see the tech stack used by the best VC firms? Download our free tech stack resource here: VC Fund Tech Stack Guide

3. The Modular Platform Team

As funds scale into their second or third vehicle, many start adding specific platform roles dedicated to talent management, business development, or content and brand building.

These platform teams generally evolve based on:

- Fund size and stage (e.g., Fund III+)

- The needs of the firm’s portfolio companies

- The preferences of the investment team

- Results from previous platform experiments

Is It Worth Building Platform Early?

Even minimal support from platforms can significantly influence your fund's performance and strengthen relationships with founders. Investing in platform capabilities not only boosts value creation after an investment but also builds greater trust with LPs, deepens engagement within the startup ecosystem, and enhances the firm’s reputation in the venture capital space.

Consequently, more VC firms, regardless of their current platform infrastructure, are prioritizing early investments in tools, talent, and community initiatives that deliver tangible support to their portfolio companies.

💡Recommended Read: Why Top VC Firms Are Betting on Vendor Ops in 2025

How Emerging VC Funds Prioritize Platform Functions: Strategic Examples

Once your fund decides a platform function adds value, the next step is identifying where to focus. Not every platform role fits every firm. Your chosen path should be based on your investment thesis, portfolio mix, and capacity. Industry data shows over 50% of VC firms now have moderate or significant platform teams, up from just ~25% in 2000. In 2022, platform talent made up 12.9% of core teams, up from 6.4% in 2000.

As a result, emerging VC firms are deliberately building platform support that fits their stage.

1. Pre-Investment Focus: Deal Flow & Branding

Best for: First-time or early funds (< $150M AUM), building visibility.

Platform functions:

- Community building via online forums or themed events

- Business development outreach to universities, accelerators, and vertical communities

- Content strategy to signal sector expertise and boost fund credibility

Why it matters: Nearly half of all venture funds now invest pre-investment resources on branding and sourcing platforms, allowing them to compete for quality deals amid growing fund launches

2. During Investment: Talent & Operations

Best for: Funds scaling their portfolio with 5–15 companies.

Platform functions:

- Talent acquisition or curated executive pipelines

- Investment operations support: standardizing data analytics for portfolio KPIs

- Vendor coordination: leading shared solutions for services like payroll, SOC-2, IT

Why it matters:

For funds scaling with 5–15 companies, investing in platform functions like talent and operations helps accelerate portfolio onboarding, reduce risk, and create a competitive edge in attracting and supporting founders.

3. Post-Investment: Growth & Value Creation

Best for: Funds with a high volume of Series A+ investments.

Platform functions:

- Dedicated Head of Platform or Platform Manager

- Structured community events or peer-learning cohorts for founders

- Investor relations support and portfolio communications

Why it matters:

For funds with a high volume of Series A+ investments, building a robust platform team enables scalable founder support, strengthens portfolio performance, and delivers measurable returns for both LPs and the fund, helping firms stand out and drive superior outcomes in a competitive market.

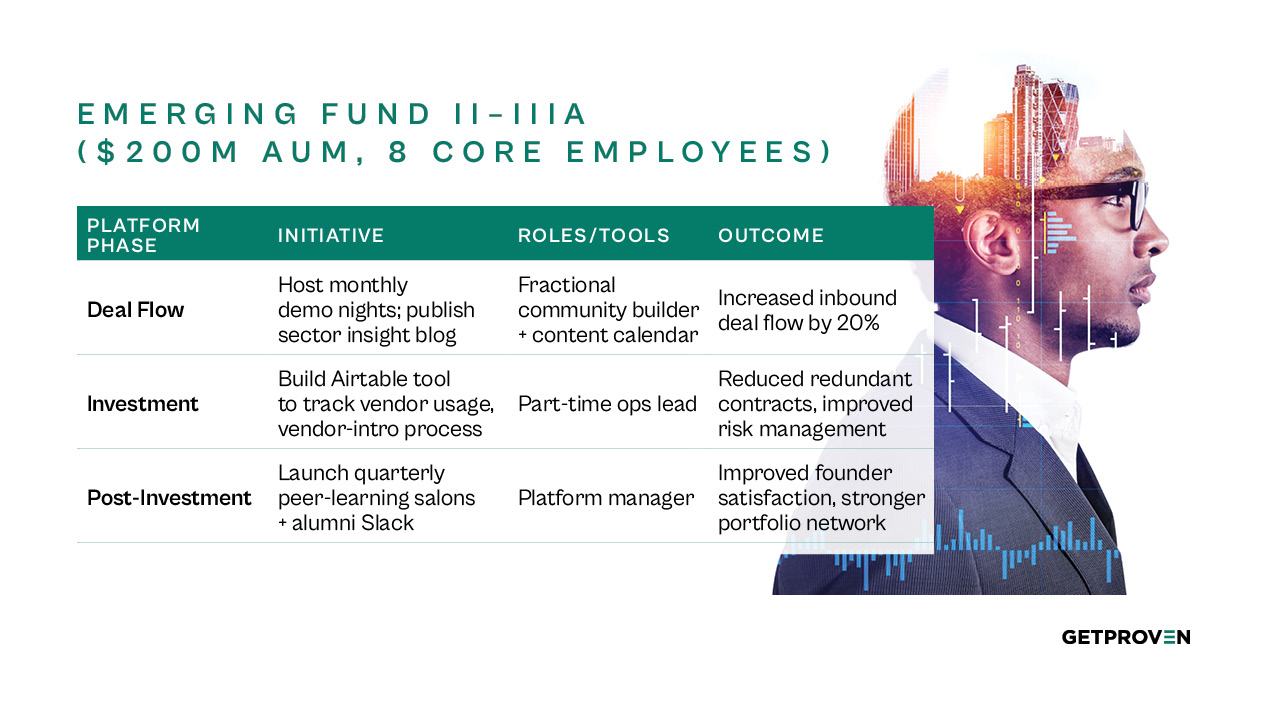

Practical Example: Evolving Platform with Fund Strategy

Choosing the Platform Right for Your Stage:

The smartest funds don’t copy platform playbooks; they build what fits their stage and ambition. Early funds win attention by building a reputation and drawing in top founders.

As the portfolios grow, hands-on talent and operational support help companies scale more quickly and manage risk effectively.

Once you've nailed that, a strong community keeps founders engaged and fuels follow-on wins. When you align your platform moves with your fund’s actual needs, you create value for founders, investors, and your team.

Get this right, and you’ll see stronger performance, deeper LP trust, and a clear edge over the competition.

Key Areas Where Platform Support Drives Real Value

Once a platform strategy is in place, the next question is: Where does it actually move the needle?

Based on how most VC platform teams operate today, here are the four highest-impact areas where even lean platform functions can drive tangible returns for both founders and the fund.

1. Deal Flow & Founder Access

For emerging VC funds, building a consistent, high-quality pipeline is everything. Platform teams can support pre-investment activities by:

- Hosting events or community touchpoints to engage future founders

- Creating content or online forums that establish the firm’s POV

- Supporting the investment team with tools to track and qualify inbound opportunities

Tools like Affinity or Airtable help VC firms streamline intake and improve early founder interactions ultimately leading to better investment decisions.

2. Post-Investment Support for Portfolio Companies

Helping portfolio founders scale is the most obvious reason to invest in a platform function. Even without a big team, firms can offer:

- Curated intros to the right service providers or fractional execs

- Shared vendor deals and a resource hub for specific non-investment functions (e.g., HR, finance, security)

- Help with talent acquisition, whether via referrals or pooled recruiter access

- Simple tools for tracking portfolio metrics, improving transparency for the investment process, and LP updates

This kind of post-investment support boosts satisfaction, creates efficiency, and builds stronger firm-founder alignment.

3. Community Building & Peer Support

One of the most underappreciated platform levers is founder community. Creating intentional space for peer support leads to stronger retention, referrals, and differentiated value.

Your platform team can:

- Organize low-lift, high-impact virtual roundtables or AMAs

- Maintain Slack groups or online forums across functions (e.g., Heads of Sales, Finance leads, etc.)

- Match founders with experienced venture partners or mentors

According to the VC Platform Global Community, nearly 70% of platform professionals say founder community-building is now a top priority, up significantly from five years ago.

4. Internal Efficiency for the Fund

Platforms aren’t just for portfolio companies. They’re also a force multiplier for the fund itself.

Platform tools and roles help:

- Reduce partner time spent on repetitive founder support

- Centralize investment operations and reporting

- Enable smarter risk management by standardizing onboarding, vendor usage, and founder engagement

- Strengthen investor relations with structured updates and clear visibility into portfolio wins

That allows the fund manager and core team to focus more on sourcing, fundraising, and market trends, while the platform handles execution and value creation.

Who Should Own Platform? The Role of the Head of Platform in Emerging VC Firms

As your fund starts to formalize its platform function, a natural question arises:

Who should lead this work and what should they actually do?

For most emerging VC funds, the answer is a Head of Platform or Platform Manager; someone who can strategically build, operationalize, and evolve your platform in alignment with fund goals, portfolio needs, and LP expectations.

What Does a Head of Platform Actually Do?

While the exact responsibilities vary based on platform strategy, stage, and resources, most heads of platform own a mix of:

1) Post-investment support: Ensuring portfolio companies have access to the right tools, talent, vendors, and templates to scale faster

2) Community building: Creating structure for peer support, events, and founder forums

3) Talent management: Supporting hiring pipelines, recruiting processes, and functional connections across the portfolio

4) Business development: Facilitating strategic partnerships or customer introductions

5) Platform operations: Coordinating internal systems and data to ensure the fund delivers consistent value

As platform professionals, they’re also often responsible for translating market trends, feedback, and performance metrics into evolving offerings, keeping the platform relevant and impactful.

What Makes a Great Platform Leader?

In most VC firms, platform roles sit at the intersection of strategy, ops, and people. The most effective platform leaders bring a blend of:

- Strong relationship-building skills with both founders and investors

- Operational know-how to systematize high-impact work

- Familiarity with venture capital fund dynamics and investment strategy

- The ability to leverage data analytics, tools, and scalable systems

- Comfort wearing multiple hats especially in lean or eight core employee teams

They don’t need to come from a finance background. In fact, many successful Heads of Platform start in marketing, HR, sales, talent acquisition, or community roles. What matters most is their ability to own the platform function and deliver tailored support to portfolio founders.

💡 Explore more: What hiring managers look for in a Head of Platform

Why Platform Roles Are One of the Best Ways to Break into VC

Here’s something not enough people realize:

Platform roles are one of the few non-investor paths into the venture capital industry.

If you’re a generalist operator, marketer, recruiter, or strategist, a platform role can be your way in, especially at firms prioritizing post-investment support, community building, or differentiated brand positioning.

These roles give you a seat at the table with portfolio companies, core team members, and the investment team, helping shape firm reputation, fund performance, and founder outcomes in a visible, strategic way.

💡Explore more: Becoming a Head of Platform in VC: 7 Essential Skills & a Career Roadmap

A Framework for Platform Design: The Platform Strategy Matrix

If you're evaluating where to focus or thinking about hiring, start with the Platform Strategy Matrix.

Developed by Cory Bolotsky, Director at VC Platform, the matrix outlines ten categories leaders can prioritize based on fund size, thesis, and portfolio maturity.

It helps firms identify gaps, assess stage fit, and structure meaningful platform investment without overbuilding. We consider it a valuable resource for fund managers, platform professionals, and anyone looking to understand the full spectrum of pre- and post-investment support.

To Learn more: Explore the Platform Strategy Matrix

Bolotsky's 10 Core Components of a VC Platform Strategy

Use this list to assess where your platform team might focus based on your fund stage, portfolio needs, and available resources.

1. Scouts & Venture Partners

Activate well-connected individuals to expand deal flow and source startups aligned with your investment strategy.

2. Content

Build brand authority through articles, podcasts, or founder playbooks that showcase your firm’s unique value-add.

3. Fellowships & Executives-in-Residence (XIRs)

Bring in experienced operators to mentor or support early-stage startups. Sometimes that can be in exchange for funding or equity.

4. Incubators & Office Space

Offer founders physical space, structured programming, or cohort-based support during their earliest stages.

5. Events & Workshops

Run intimate dinners, AMAs, or tactical workshops that drive community building and peer learning across your portfolio.

6. Online Forums & Digital Communities

Create channels (Slack, email groups, custom platforms) for founders to ask questions, share advice, and connect functionally.

7. Expert Networks

Curate a roster of advisors, mentors, or operators who can be matched with portfolio companies for short-term, targeted support.

8. Corporate Relations

Connect founders with enterprise partners and strategic customers—especially valuable for B2B portfolios.

9. Talent

Support hiring via job boards, warm intros, recruiter referrals, or in-house talent acquisition expertise.

10. Expertise-as-a-Service

Offer tactical, fee-based or free support (design, finance, marketing, product) from vetted specialists to accelerate execution.

Pro Tip: You Don’t Need All 10

Start by identifying 2–3 categories where you can offer tailored support based on what your portfolio founders need most.

Then scale intentionally as your platform function and fund evolve.

Examples of Great VC Platform Tools and What Makes Them Work

Not every VC platform team needs to build everything in-house. Many venture capital firms use external tools to power key platform functions from portfolio management to vendor operations, investor relations, and beyond.

Here are three leading solutions that show how technology can enhance a fund’s platform strategy and support growing portfolio companies efficiently.

1) Backstop Solutions

Best for: Investment operations, reporting, and fund management.

Backstop Solutions is an all-in-one, cloud-based platform designed for alternative investment managers, including venture capital funds. Its strength lies in helping firms centralize data, improve decision-making, and streamline operational complexity.

Key capabilities include:

- Centralized data management across deals, documents, LPs, and communications

- Deal flow tracking with workflows for sourcing, diligence, and pipeline review

- Investor relations tools like fundraising CRMs, IRM dashboards, and investor portals

- Portfolio performance analytics for reporting, benchmarking, and attribution

- Compliance workflows and document version control

- Seamless integration with CRMs, accounting platforms, and data providers

Why it matters for VC firms:

Backstop enables VC platform teams to consolidate operational systems, reduce manual processes, and improve visibility across the full investment lifecycle. Source: Backstop Solutions official site, client testimonials, and industry publications

2) Carta

Best for: Cap table management, portfolio tracking, and founder communication.

Carta is a leading platform in the venture capital industry for simplifying portfolio monitoring, ownership tracking, and LP communications. It’s widely used across small and large VC firms alike.

Core platform support includes:

- Real-time portfolio company performance tracking

- Streamlined cap table and equity management

- Automated valuation updates and dilution modeling

- Customizable investor reports and dashboards

- Secure document sharing and compliance tools

- API integrations with other VC fund tech stacks

Why it matters for platform professionals:

Carta reduces the friction of post-investment financial ops giving platform leads and investment teams a shared source of truth while keeping portfolio founders informed and confident. Source: Carta official site, TechCrunch, Bloomberg, and customer reviews

Want a great deal on Carta? Explore our marketplace.

3) Proven

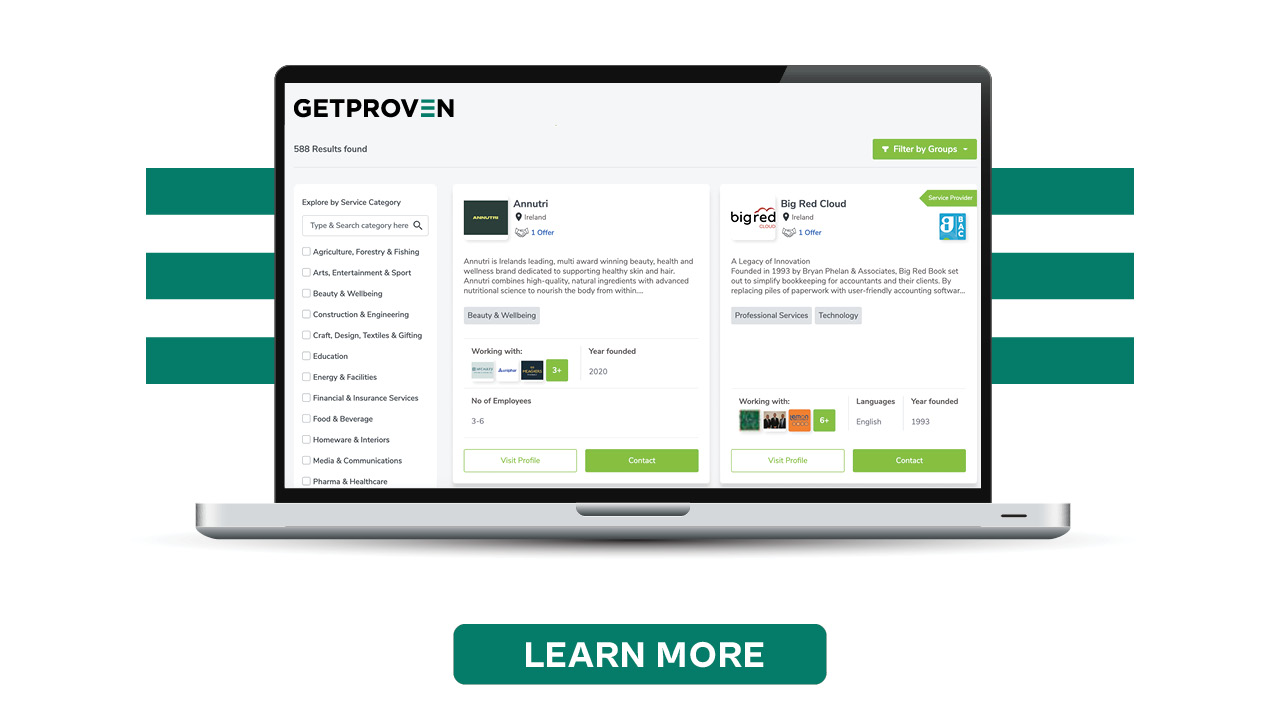

Best for: Vendor management, cost savings, and scalable founder services.

Proven is a platform purpose-built for alternative investment firms, including early- and growth-stage venture funds, to manage vendors, unlock exclusive deals, and build scalable platform functions without heavy headcount.

Key features include:

- Centralized vendor relationship management

- Workflow automation for vendor onboarding, compliance, and contract tracking

- Real-time performance reporting across vendor categories

- Curated deal marketplace with discounts on 300+ startup-relevant tools

- Support for peer-to-peer vendor reviews and recommendations

- Startup community-building via shared resource hubs and peer forums

Why it matters for small-to-mid-sized firms:

Proven helps platform managers deliver real value to portfolio founders through cost optimization, operational efficiency, and faster execution without needing a significant platform team. Source: Proven official site, VC client interviews, and industry publications

What Founders Really Want from VC Platforms

You’ve probably heard that “platform” is all about adding value. But what exactly does that mean to the people it’s supposed to help?

To answer that, we need to flip the lens. The best platform strategies don’t start with internal capabilities; they start with founder needs.

Do You Know What Founders Actually Want?

According to First Round Capital’s State of Startups, founders consistently rank the following as the most valuable support a VC can provide:

- Talent: Introductions to key hires, vetted recruiters, and advice on how to structure a team

- Business development: Warm customer or partner intros that unlock deals or distribution

- Fundraising: Guidance on follow-on rounds, pitch reviews, and LP introductions

- Operational support: Templates, tools, or vendor recommendations to speed up execution

- Strategic sounding board: Thoughtful, founder-first feedback during hard or complex decisions

In other words, founders want leverage, not micromanagement. They’re not looking for you to solve every problem but they deeply value curated, timely support that helps them solve their own problems faster.

What Founders Don’t Want

It’s just as important to understand what platform support shouldn’t be.

From community polls and operator conversations in the VC Platform Global Community, here are the most common founder complaints about underwhelming platform offerings:

- “Another bloated resource library with no real guidance”

- “Too many disconnected tools and logins”

- “Too much noise in the Slack group; hard to find value”

- “Generic office hours that aren’t relevant to my stage or sector”

- “I don’t want to ask my investor for help, but I wish they’d just offer it more often”

The takeaway? Intentional, right-sized, and proactive beats broad and flashy. It’s not about offering everything. it’s about delivering what’s actually useful to your portfolio companies. Remember that before building or buying any flashy tools.

A Founder-First Platform Strategy

The most successful platform teams think like product managers:

- They identify founder pain points

- Validate needs through direct feedback

- Build lean, repeatable solutions

- Iterate based on usage, not assumptions

For emerging venture capital firms, this might mean:

- Curating a shortlist of trusted vendors instead of building a full-fledged marketplace

- Offering 1:1 talent office hours instead of launching a full recruiting arm

- Sending tailored intros instead of scaling “community” too soon

It doesn’t have to be big to be meaningful. It just has to be extremely relevant, timely, and founder-informed.

Your founders will tell you exactly where your platform can shine.]

Wrapping Up

Platform Is No Longer Optional for Emerging VC Firms

If you're an emerging fund with a lean team, growing portfolio, and increasingly high founder expectations, you don't need to be told that capital alone is no longer a differentiator.

A thoughtful, right-sized VC platform strategy gives you leverage:

- To win better deals

- To support founders in ways that actually move the needle

- To scale value without ballooning headcount

- To boost fund performance and LP confidence over time

And here's the good news:

You don’t need a “significant platform team” to get started. You need clarity, intent, and a few systems that align with your investment strategy, portfolio stage, and team capacity.

Key Takeaways

- A VC platform is the structured way your fund delivers value beyond capital, through tools, talent, community, and strategic support.

- There’s no one-size-fits-all model. Platform strategy should reflect your fund’s thesis, portfolio maturity, and goals.

- Even one platform professional or a handful of smart tools (like Proven, Carta, or Backstop) can materially impact your portfolio companies.

- Founders don’t want noise. They want targeted, timely help. Ask them what matters.

- Platform is no longer reserved for large firms. Many VC firms are building lean platforms earlier than ever.

What’s Next?

If you’re still in research mode, this guide is your foundation. When you're ready, explore:

- Unlock The Power of a VC Platform: A Beginner's Guide on Why You Need It, What To Look For, and Why Choose A Platform?

- The Power of Community in VC Platforms: Driving Success and Enhanced Returns

- What Hiring Managers Look for in a Head of Platform

No matter your next step, remember:

Platform isn’t a cost center. It’s a reputation engine, a founder magnet, and a driver of real fund value.