Why Top VC Platform Teams Are Betting on Vendor Ops in 2025

As a Head of Platform or Operating Partner, your job isn’t just to “support founders.” It’s to operationalize value across the portfolio and prove it.

In 2025, that means moving beyond reactive portfolio management and into system-level thinking. Investors expect more. Founders move faster. And GPs want answers, not anecdotes.

Yet while funds invest in GTM advisors, talent networks, and VC tech stacks, one critical layer still lags behind: vendor operations.

Vendor management remains one of the most fragmented, manual, and underleveraged parts of the modern VC platform. Spreadsheets get stale. Slack threads get lost. Founders make the same vendor decisions—blindly, and often expensively.

Here’s what top-performing platform professionals and teams are doing differently:

They’re treating vendor management as a fund-level system, not a side task.

This article will show you:

- The hidden costs of fragmented vendor ops

- How a modern vendor management layer delivers operational ROI

- What leading VC teams look for in a scalable vendor platform

- How to make the case to GPs and LPs—and lead with data

Because in the high-stakes venture capital industry where execution is everything, vendor operations might be the cleanest win your platform can deliver this year.

The Hidden Costs of Vendor Chaos

Vendor chaos doesn’t show up on a dashboard. But it shows up everywhere else—in onboarding delays, higher burn rates, founder friction, lost deals, compliance lapses, and platform teams stuck in operational triage.

And yet, it’s easy to overlook because it’s rarely labeled as a “vendor issue.” It just manifests as inefficiency, missed opportunities, and mounting requests.

When portfolio companies choose vendors in silos—without shared intel, data, or structure—the platform team becomes the human band-aid: combing through email threads, forwarding the same intros, and answering the same five questions every month. Sound familiar?

Let’s make the cost of this chaos painfully clear:

1) Time You'll Never Get Back

Does this sound familiar?

“Do we know anyone for SOC 2?”

“Have any other portcos used this IT provider?”

“Can you intro me to a good outsourced CFO?”

Instead of having a system, you’re the system. That’s not scalable.

How many hours do you spend each quarter fielding the same vendor requests? You may not have realized it yet, but every time you answer these types of questions, you're not just responding to inquiries. You’re rebuilding institutional knowledge each time a founder contacts you.

When you act as the single source of truth, you can’t focus on the higher-leverage work. You’re in inbox triage, not strategic enablement.

2) Missed Negotiation Power

If three or five of your portfolio companies are using the same CRM, dev agency, or payroll platform, but each one signed up independently, you’ve left money on the table.

That’s volume pricing you didn’t claim.

That’s bundled onboarding support you didn’t secure. That’s data on vendor performance you didn’t centralize.

Vendor overlap can be a strategic asset, but only if you have visibility into it. Without clear and organized financial information, you have no way of leveraging it.

3) No Visibility = No Accountability

Without centralized vendor tracking, your firm is flying blind:

- You don’t know which vendors are active across your companies

- You don’t have performance feedback or satisfaction metrics

- You don’t know who’s overspending or underutilizing

- You can’t surface patterns or highlight red flags

No data analytics means you can’t optimize anything.

It also means you can’t credibly report on value delivered or dollars saved—which is becoming table stakes for modern platform teams.

4) Increased Risk Exposure

Siloed vendor decisions create risk, plain and simple.

- Contracts get signed without proper review

- Compliance gaps (SOC 2, GDPR, HIPAA) go unchecked

- Renewals happen automatically with no oversight

- Vendor lock-in creeps up without recourse

These aren’t just admin headaches. They’re governance, reputational, and even security risks. All are preventable with a system that tracks, alerts, and standardizes vendor relationships.

5) Platform Burnout

Most platform leaders didn’t join a VC firm to become the help desk.

When you’re stuck putting out the same operational fires again and again, you’re not adding scalable value; you’re just doing time-consuming busywork. And busywork leads to burnout.

Great platform work is about leverage, not load. And vendor chaos is a load that only gets heavier unless you build a smarter system.

Vendor Ops as a Strategic Lever (Not a Tactical Task)

In most funds, vendor support is still seen as a background function, something nice to have but not mission-critical. It's not like it's scouting potential investments, performing due diligence, or securing deal flow for the firm, right? So it’s often delegated, reactive, and under-resourced.

But the most advanced platform teams are flipping that script.

They’ve realized vendor ops isn’t just back-office support. It’s a multiplier for fund performance. A force function that turns chaos into clarity, waste into savings, and ad hoc help into measurable impact.

When managed strategically, vendor operations aren’t just logistics. They’re leverage for your firm. And that's why vendor management for VC platform teams is a game-changer. How?

1. It Speeds Up Execution Across The Portfolio

Startups live and die by speed. Every week spent vetting tools, chasing founder referrals, or trying to decode feature matrices is a week not spent building product or talking to customers. In other words, it's a week not spent optimizing investment opportunities.

A centralized vendor infrastructure changes that.

Instead of starting from scratch every time a portco needs a data warehouse, a digital marketing agency, or an HRIS, you hand them vetted options, peer feedback, and pre-negotiated terms on day one.

2. It Impacts Burn and Budget

When vendor decisions are made in isolation, each company ends up negotiating from scratch, usually without leverage and often overpaying.

- One startup pays $8,000 a year for a CRM

- Another pays $12,000 for the same package

- A third never even knew there was a discount program and went with a lower quality solution

That’s not just waste; it’s misalignment. And at scale, across 20+ companies, it adds up to hundreds of thousands in unnecessary spending.

Smart vendor ops surfaces these overlaps, pools buying power, and turns individual purchases into a collective advantage.

3. It Generates Trackable, Reportable Value

The hardest thing about platform work? Measuring it. It's just really hard to quantify the anecdotal support or conversations you helped forge, especially when information is scattered across documents or threads updated with manual data entry.

But vendor management is different. Done right, it becomes a source of clean, quantifiable data:

- Time saved from faster vendor onboarding

- Dollars saved through bulk discounts and preferred pricing

- Satisfaction scores from portfolio feedback

- Usage metrics and contract renewals across vendors

This is the kind of operational intelligence that LPs love because it turns “platform impact” from a story into a dashboard. And by leveraging emerging technologies and software solutions, you can get this kind of insight into key performance indicators (KPIs) in real-time.

4. It Reduces Operational Risk

Startups often sign contracts fast. Too fast.

- No security review

- No compliance vetting

- No understanding of long-term lock-in or auto-renewal clauses

Without oversight, the fund inherits these risks by proxy, from privacy issues to missed renewal deadlines to unvetted third-party tools sitting in their data stack.

A vendor platform brings structure and standards:

- Systemized onboarding workflows

- Flags for missing compliance docs

- Notifications before auto-renewals hit

- Clear visibility into who’s using what, and how

5. It Elevates the Platform Role

When you tame chaos, you gain influence.

Platform leaders who build structured vendor ecosystems don’t just make life easier for founders; they become indispensable.

You’re not just “helping” anymore. You’re enabling better decision-making, faster scale, and cleaner operations across the board.

You become the architect of a valuable resource that saves money, reduces risk, improves founder NPS, and demonstrates value to limited partners.

And in a market where GPs are asking harder questions about platform ROI, that’s your moment to shine.

What Top Platform Teams Look for in a Vendor Ops Platform

If you’re leading a modern VC platform, you don’t need another place to paste links. You need leverage.

The best platform teams aren’t chasing spreadsheets or waiting on intros. They’re running vendor operations like a shared service. That means tools that scale strategy, not just store data.

So, what separates a tactical vendor database from a true platform-layer advantage that enables VC firms to dominate?

Let’s break down the key features the most effective platform leaders look for:

1. Portfolio-Wide Visibility

Visibility isn’t just about knowing what’s happening; it’s about unlocking smarter, faster decisions at every level.

You can’t optimize what you can’t see.

A strategic vendor ops platform offers a live, unified view of:

- Which vendors are being used, by whom, and for what

- Where vendor fatigue is setting in (e.g., 10 tools for email marketing)

- What’s working and what’s not based on real-world usage and outcomes

This takes data management to a whole new level.

No longer are you stuck in fractured document management, tracking invoices here, requests there, never really knowing which contracts are useful and which are wasteful. With a centralized dashboard, you see everything, the good and the bad. (And performance tracking becomes easier, too.)

This kind of visibility eliminates duplicated effort, unlocks cross-company insights, and creates leverage in negotiations. It also helps surface white space: Where are vendors missing? What are your founders struggling to find?

2. Internal Social Proof and Portco Feedback

Founders trust other founders more than they trust any rating system.

A high-performing platform doesn’t just offer vendor listings. It shows:

- Which vendors are most loved (and most loathed) across the portfolio

- Who’s actually used them, and whether they’d recommend them again

- Contextual feedback tied to stage, vertical, and outcomes

This is how you replace guesswork with confidence and help portcos make better vendor investment decisions. It’s not a directory, it’s a networked layer of trust.

And having it live in a centralized location means more efficient communication between portcos and saved time and effort for your team.

3. Savings Tracking and ROI Reporting

If vendor ops is going to be a strategic lever, it has to be measurable.

The right platform should:

- Track redemption of deals, perks, and discounts

- Estimate cumulative cost savings across the portfolio

- Attribute time saved and reduced risk to specific actions

This is the kind of operational transparency that resonates with GPs and turns anecdotal platform support into clear ROI.

4. Standardized Workflows to Reduce Risk

Vendor selection doesn’t need to be rigid but it does need to be responsible.

A mature vendor ops platform offers:

- Repeatable onboarding checklists (e.g., security review, compliance docs)

- Smart reminders about renewal cycles and contract expirations

- Centralized document storage for audit trails and legal reference

This is not about creating bureaucracy; it’s about incorporating straightforward risk assessment and management into a typically chaotic process. Standardization brings consistency while preserving flexibility. This approach enables scaling quality across 5, 15, or even 50 companies.

5. Scalable, Self-Serve Access for Portcos

Great platform support doesn’t mean constant hand-holding. In fact, the most appreciated systems are the ones that don’t require asking for help.

Modern vendor ops platforms empower founders with:

- Searchable vendor directories with filters for category, use case, or stage

- Personalized suggestions based on company needs and feedback loops

- A way to leave and browse internal reviews so that insight compounds over time

This is what scalable support looks like: it’s not just efficient; it’s truly empowering! Founders appreciate clarity over friction, and by providing them with a well-vetted path forward, we build trust together. This approach also allows your team to spend more time on the impactful work that really makes a difference.

The best vendor ops platforms don’t just organize information. They drive alignment, surface savings, and grow as your fund grows.

Want to see what that looks like in action? Book a demo with Proven or Try it for free

Operational Wins in Practice

It’s easy to talk about vendor chaos in the abstract. It’s harder but far more powerful to show what happens when a platform team builds a system that actually works.

Here’s what vendor ops looks like in action, and why it matters.

The Scenario

A mid-sized VC firm with 30+ active portfolio companies had no formal vendor management system. Platform leads fielded dozens of repetitive requests each month:

- “Any feedback on this product design agency?”

- “Anyone used a recruiting firm that specializes in early-stage?”

- “Is this marketing agency legit?”

Every answer required digging through Notion, searching Slack, or emailing the same 3 people. Some info was outdated. Some was anecdotal. And most of it lived in silos.

Founders were making the same decisions in a vacuum and often overpaying or picking the wrong partner.

The Transformation

The platform team adopted a centralized vendor operations platform built to:

- Track vendor usage across the portfolio

- Surface founder feedback and reviews

- Unlock pre-negotiated group discounts

- Provide self-serve access for portcos

They rolled it out with light onboarding, a simple feedback workflow, and clear internal positioning: “This is your shortcut to vetted, trusted vendors backed by your peers.”

The Results After 6 Months

- 3x faster average vendor selection cycle (from 2 weeks to under 5 days)

- $180K+ in documented vendor savings (thanks to group deals and fewer bad-fit hires)

- 85% portco satisfaction rating (based on feedback surveys after vendor engagements)

- Full visibility into 200+ vendor engagements (including contract status, categories, and feedback)

And perhaps most importantly, the platform team reduced their inbound vendor request volume by over 60% because founders were getting what they needed without waiting.

This wasn’t a unicorn use case. It was the natural result of systematizing something that was previously stuck in Slack.

Want help making this your firm’s next operational win? Book a walkthrough of Proven’s vendor ops platform

Section 5: KPIs That Matter to Platform Teams and Operating Partners

Vendor ops might feel tactical, but the best platform leaders know how to tie it to real numbers that resonate with GPs, LPs, and founders alike.

A modern vendor management platform doesn’t just streamline workflows; it gives you clean, actionable data to track the efficiency, value, and impact of your operational strategy.

Here are the top three KPIs platform teams are tracking:

1. Time-to-Selection

What it measures:

The average number of days it takes a portfolio company to go from a vendor request to an active engagement.

Why it matters:

Speed = competitive advantage. Faster decisions mean founders can execute quicker and avoid bottlenecks. It also reduces repeated asks to the platform team.

2. Total Cost Savings Across the Portfolio

What it measures:

The cumulative dollar amount saved by portfolio companies through shared deals, group discounts, and avoidance of high-cost, low-fit vendors.

Why it matters:

This is your most direct, quantifiable proof of platform ROI. It’s a powerful number to surface in LP updates or board decks.

3. Vendor Satisfaction / NPS

What it measures:

The percentage of portfolio companies that would recommend a vendor after using them (gathered via simple feedback surveys).

Why it matters:

High satisfaction builds trust in the platform, drives future adoption, and helps eliminate underperforming vendors from your stack.

The right platform not only supports these KPIs, but also tracks them automatically, providing insight into what’s working, what’s improving, and what’s creating real value, and equipping you with everything you need to maintain strong investor relations.

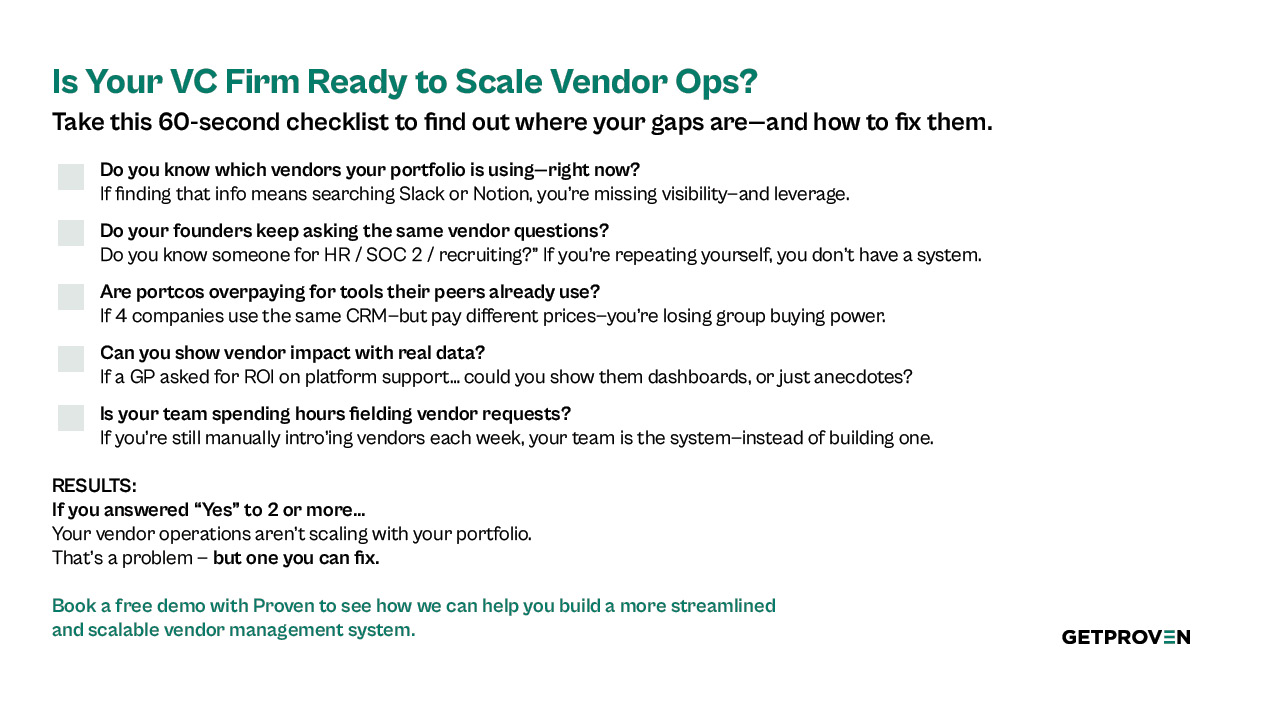

Is Your VC Firm Ready? (Self-Assessment Checklist)

Not sure if now’s the right time to invest in a vendor operations platform? Start here.

This 5-point checklist will help you assess how mature, scalable, and effective your current vendor management approach really is and whether it’s time to upgrade from reactive help to a system that scales.

Getting Buy-In – How to Make the Business Case Internally

You feel the inefficiencies. You see the opportunity. Now it’s time to bring your partners along.

Here’s how top platform leaders frame the case clearly, strategically, and in the language venture capitalists listen to.

Lead with Outcomes, Not Tools

Don’t sell “software.” Sell leverage.

“This isn’t about buying a tool. It’s about cutting burn, speeding execution, and proving platform ROI.”

Frame vendor ops in terms that matter at the fund level:

- Faster vendor selection = faster execution

- Shared discounts = reduced burn

- Tracked usage = operational reporting for LPs

Show the Cost of Doing Nothing

Start with what’s broken:

“We can’t see who’s using what.”

“We field the same vendor asks every week.”

“We’ve missed group savings across multiple portcos.”

Then show what a platform unlocks:

- Real-time vendor maps

- Tracked redemptions and savings

- Founder ratings and feedback loops

Bonus: Use a simple ROI calculator to forecast potential savings.

Tie It to Fund-Level Outcomes

“A vendor platform helps us deliver real value to founders and show it to LPs.”

“It creates scalable structure, not one-off solutions.”

“It sets us up for consistency across funds.”

Start Small, Scale Fast

Ease friction by proposing a pilot:

- Roll out to 5–10 portcos

- Measure time saved, vendor adoption, and feedback

- Present results in the next ops or partner meeting

Don't pitch a platform. Propose a system that creates compounding value across the fund.

Conclusion

The most forward-thinking venture capital firms aren’t waiting for vendor chaos to sort itself out. They’re building systems that scale.

Vendor operations may not be as top of mind as deal flow management or affect the investment process of your fund, but it is leverage, savings, and strategy wrapped into one. Done right, it can be your firm's competitive edge, even when stacked against what most alternative asset managers would consider more valuable.

Since your founders need speed and your GPs need proof. Your team needs a platform.

Try Proven for free or estimate how much your portfolio could be saving today.