How to Build Your VC Platform Without a Big Team or Budget

For most venture capital firms, the idea of building a platform sounds great in theory until reality sets in: limited headcount, limited budget, and competing priorities.

You get the value of a platform. You know founders want post-investment support. But how do you build something meaningful without hiring a robust platform team or burning through capital?

The good news? Many VC firms are proving that you don’t need to go big to make an impact. With the right strategy, smart tools, and focused execution, even lean teams can deliver tailored support that founders love and LPs respect.

In this guide, we’ll walk you through how to build a VC platform that’s scalable, founder-friendly, and budget-conscious.

Want to understand what a VC platform is first? Read: What is a VC Platform and Why Emerging Funds Are Building One Now

Step 1: Define the Right Platform Strategy for Your Fund

Not all venture capital firms need the same platform structure. Your platform function should align with your fund’s investment strategy, portfolio composition, and stage.

Start by identifying your portfolio’s most critical needs.

Early-stage startups often need help with talent acquisition, operational support, and strategic partnerships. Later-stage companies may prioritize cap table management, portfolio monitoring, and investor relations tools.

Use frameworks like Cory Bolotsky’s Platform Strategy Matrix to identify which of the 10 core categories (e.g., business development, talent management, community building) make sense to prioritize.

Resist the urge to copy what large venture funds do because their platform teams and resources are not your starting point.

We explored the 10 Platform Categories in our guide here → What is a VC Platform?

Step 2: Talk to Your Founders, Then Build for Them

Too often, operations teams design platforms based on internal assumptions or the preferences of fund managers, missing the mark on what truly matters to founders. The smarter, more impactful approach is to build around the real, evolving needs of your portfolio founders.

Start by making founder engagement a core part of your platform strategy. Don’t just guess—ask.

Send a concise, thoughtfully crafted survey or weave targeted questions into your regular check-ins. This not only signals that you value their input, but also uncovers actionable insights that might otherwise go unnoticed.

Consider questions like:

- What’s the single biggest bottleneck slowing you down this quarter?

- If you could hire one role or onboard one vendor today, what would move the needle most?

- Where do you wish you had more peer support, shared knowledge, or access to best practices?

- Since joining our fund, what’s been your most persistent headache or unexpected challenge?

- In what areas do you wish LPs or our leadership team could offer more hands-on help?

Go beyond the survey. Listen actively during founder calls, portfolio reviews, and informal conversations.

Patterns will emerge: maybe it’s a lack of vetted vendor recommendations, a need for warm intros to other founders, or a desire for more transparent communication from the fund. These insights are gold.

They reveal where your platform team can deliver the most value, whether that’s negotiating exclusive deals, building a founder community, facilitating strategic partnerships, or simply removing friction from everyday operations.

Remember, founders’ needs shift as their companies grow. Early-stage teams might crave tactical hiring support or operational playbooks, while later-stage founders may prioritize investor relations or advanced analytics. Make it a habit to revisit these conversations regularly, ensuring your platform evolves alongside your portfolio.

Finally, close the loop. Share back what you’ve learned and how you’re acting on it. This builds trust, demonstrates responsiveness, and encourages ongoing engagement. When founders see their feedback shaping your platform’s offerings, they’re more likely to participate, share candidly, and champion your fund within their networks.

For a deeper dive into founder priorities and actionable platform strategies, check out the section “What Founders Really Want From VC Platforms” in our guide: → What Is a VC Platform? Why Emerging Funds Are Building One Now

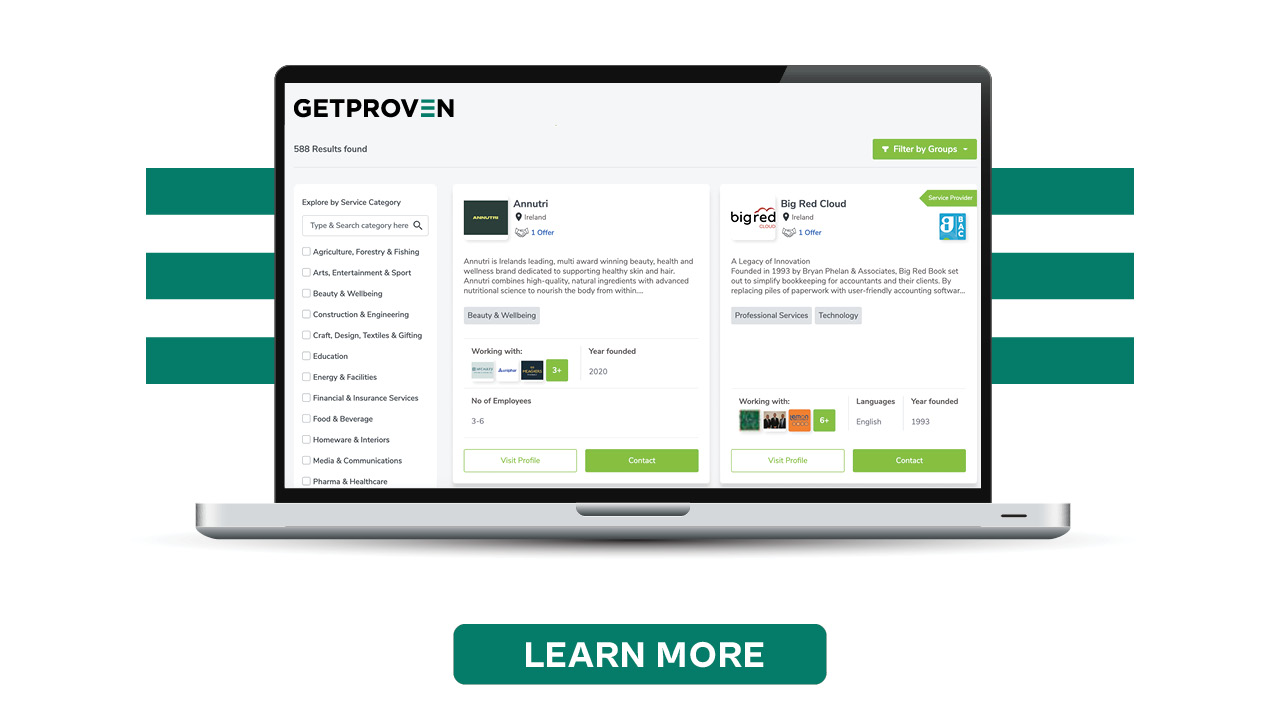

Step 3: Use Tools to Replace Headcount (For Now)

Many venture capital firms use tools to deliver post-investment support without a big team. Here are some examples:

- Proven for vendor management, exclusive deals, and operational efficiency

- Carta for cap table management, equity management, and portfolio performance

- Backstop for portfolio monitoring, investor relations tools, risk management, and data analytics

- Notion, Airtable, and Slack for resource sharing, onboarding, asynchronous founder support, and community building, peer support

For example, use Notion to build a shared founder hub with onboarding docs, recommended tools, and introductions to preferred vendors. Use Slack to launch a private founder channel and run AMAs or job drops. Set up Airtable workflows for tracking platform requests and founder needs across portfolio companies.

Platform professionals in lean firms often act as a "platform manager + product manager" hybrid, setting up automations, evaluating platform tools, and scaling platform support through tech rather than headcount.

Here’s a simple tech stack template for teams of one:

- Deal flow & CRM: Affinity or HubSpot

- Community & async engagement: Slack + Notion

- Resource tracking & requests: Airtable forms

- Post-investment reporting & visibility: Carta or Backstop

- Exclusive savings, vendor discounts & streamlining: Proven

Pro Tip: Platforms like Carta and Proven also help your investment team with portfolio visibility, improved investment decisions, strategic support, and long-term operational efficiency. Ensure you deploy them strategically and get your team to maximize their potential so that they can do more than just portfolio management.

Step 4: Launch a Lightweight Founder Community

You don’t need a large platform team or an event-heavy calendar to build a thriving founder community. In fact, many of the most effective VC platform teams start small with a clear purpose, smart structure, and founder-first intent.

Done well, a lightweight community can be one of the most scalable, founder-loved aspects of your platform function.

It becomes a space for tactical knowledge exchange, peer mentorship, and relationship-building that directly supports business development and portfolio growth.

Here’s how to make it meaningful (and manageable):

1) Start with a simple, founders-only network.

The best VC platform communities don’t try to do everything; they do one thing well. Create a founder-exclusive space where trust and relevance are baked in.

- Use a platform your founders already check (Slack, WhatsApp, Circle, or curated email threads).

- Brand it around exclusivity and shared goals. This isn't just another “update thread.” It’s a founder circle with real utility value.

- Have your Head of Platform (or platform manager) post a short welcome and onboarding guide that sets expectations and tone.

Remember, your goal isn’t noise. It’s connection that creates value across your firm’s portfolio companies.

2) Curate content that delivers strategic guidance.

Avoid posting generic VC think-pieces. Instead, use your platform role to surface high-leverage, founder-tested resources:

- Market trends that matter for seed and Series A companies

- Templates and frameworks that worked for other portfolio founders

- Introductions to vetted service providers or potential partners

- Practical hiring, go-to-market, or fundraising insights from within the group

This turns your community into a real-time value engine, not just a social space, and reinforces your platform function as a core driver of strategic support.

3) Host lightweight peer circles, not webinars.

One of the easiest ways to deepen engagement is to run quarterly founder peer sessions—think of them as tactical, founder-led meetups.

- 60 minutes on a single theme: hiring, metrics, leadership, founder mental health, etc.

- Use breakout rooms or rotating hot seats for more connection

- Ask a portfolio founder or external guest to share a short opener (no slides, just lessons)

These events are gold for community-building in early-stage VC portfolios. They create peer support, shared vulnerability, and insights that even your best content can’t replicate.

4) Nominate “community champions” to scale organically.

If your VC platform team is lean (and it probably is), scale engagement by empowering insiders. Identify 2–3 engaged founders and invite them to:

- Run a short Q&A on a niche topic they’ve mastered (e.g., first sales hire, board prep)

- Host a virtual co-working session

- Curate a vendor shortlist in their area of expertise

This builds shared ownership and keeps your platform and community from becoming top-down or overly formal. It also lets you support founders without becoming a bottleneck.

5) Let the community evolve based on needs

Some venture capital firms try to overengineer community with preset tracks and monthly events. But founders are busy, and your job is to reduce overwhelm, not add to it.

Focus instead on:

- Quality of interaction > quantity of participation

- Creating strategic moments of relevance (especially around big founder milestones like hiring, fundraising, or go-to-market launches)

- Encouraging founders to “pull,” not just receive, by asking questions and offering guidance

You’ll know it’s working when the group starts supporting founders without your prompting and takes actions like sharing referrals, offering introductions, or recommending curated tools.

That's the real magic of building a VC platform, global community with founders. It’s not always flashy, but it’s foundational to long-term portfolio value.

💡Want fresh, actionable ideas to spark an engaged founder community? Download this free resource → 11 Creative Ways To Build An Engaged Founder Community

Step 5: Measure What Matters, Not Everything

Early-stage VC platform efforts don’t require elaborate dashboards or a tangle of OKRs. In fact, trying to measure everything can easily distract from the real question: is your support actually making a difference for portfolio founders?

Instead, focus on a few core dimensions that truly reflect your platform’s impact. First, consider adoption. Are portfolio companies genuinely engaging with what you offer?

This could mean active participation in community groups, frequent visits to your resource hub, redemption of vendor deals, or direct requests for tailored support. Even something as simple as tracking engagement in an Airtable log can reveal meaningful traction.

Next, seek out feedback. Are founders finding your support helpful, accessible, and delivered at the right time? Don’t wait for annual reviews; run quick micro-surveys each quarter, embed a one-click feedback tool in shared Notion docs, or ask for candid input during regular check-ins. The goal is to keep a pulse on founder sentiment and spot opportunities to improve.

Most importantly, look for outcomes. Did your efforts lead to faster hiring, smoother equity management, cost savings through vendor discounts, or more efficient investor relations? Whenever possible, connect your platform activities to tangible improvements in portfolio performance or founder satisfaction.

Anecdotes are powerful, but pairing them with data is even better. If a founder hires an outstanding Head of Growth through your referral network, that’s a story worth sharing. If half your portfolio saves 25% by using a vetted legal vendor, that’s compelling evidence.

Use these insights not just to validate your work, but to shape and refine your platform function over time. They’ll help you report back to your investment team, justify further investment in platform initiatives, and strengthen your case when updating LPs.

In a landscape where many VC firms are still figuring out how to measure platform value, your ability to tell a credible, data-backed story without overcomplicating things can set you apart.

Above all, remember: clarity beats complexity. Focus on what matters most, and let your results speak for themselves.

Your Takeaway: Start Small, Deliver Value, Grow from There

You don’t need a 10-person platform team or a multi-million-dollar war chest to make an impact. What you need is focus: on your founders, on your thesis, and on the systems that can scale your support without draining your time or budget.

Smart VC platforms today are being built with fewer people, tighter feedback loops, and sharper tools. And for emerging venture capital firms, that’s good news because it means you can start delivering real post-investment value now, not “someday.”

By aligning platform efforts with your investment strategy, using tech to replace headcount, and building around what your portfolio companies truly need, you’ll set your firm apart. You'll move from just capital to real strategic support and from reactive help to measurable impact.

And if you're looking for the fastest, leanest way to prove platform value today?

Start with what nearly every founder needs: reliable vendors, vetted tools, and real cost savings.

Explore Proven: The Vendor Management Platform Built for VC Funds

Discover how lean platform teams and early-stage VC firms are using Proven to support portfolio companies, reduce friction, and unlock scalable post-investment support without hiring a full team. Get Started with Proven.